Every year, WordStream puts out a State of the Agency report on what makes digital marketing firms tick. The findings help agencies and marketers orient themselves to the bigger picture and identify where and how they can improve.

Similarly, Promethean Research has conducted a recent survey for digital agencies with regard to COVID-19. Rather than focusing solely on the negative impacts of the pandemic, the goal was to discover agencies or their particular functions that were doing well. The responses revealed that there are agencies out there that are not just surviving, but thriving in 2020; and also that there are patterns among these firms. Everything was compiled into one 72-page report called The Pattern Report.

Here we have summarized the key takeaways of The Pattern Report. It will provide an overall picture of agency outlooks for the second half of 2020, as well as patterns of resilient firms in three key areas:

- Operations—work environment, tools available, and team structures.

- Management—including billing, people, and stress management.

- Growth—in terms of offerings, marketing strategies, and capital.

The overall outlook of agencies for the second half of 2020

Survey respondents skewed slightly towards more positive outlooks for the second half of the year: 36% of firms had an optimistic outlook while 24% had a pessimistic outlook. Almost half of respondents expected business conditions to remain unchanged.

Small firms tended to be more optimistic than large ones. Firms who specialize in real estate, consumer goods, government and non-profit, and professional services tended towards the most pessimistic outlook. Nearly 76% of respondents have the same or more positive outlook for the second half of 2020 compared to the first half.

Patterns of optimistic digital agencies in 2020

As mentioned, smaller firms had more neutral or optimistic outlooks than larger firms. Looking more closely at these optimistic firms, much of their downtime during the second quarter was spent reorganizing, repositioning, restructuring their internal operations, and raising or intending to raise capital. Many were well-prepared for a distributed working environment and remote tools and were already starting to see increased client demand in May. Most firms have experienced project cancellations but haven’t renegotiated terms even when the cancellations are in breach of contract.

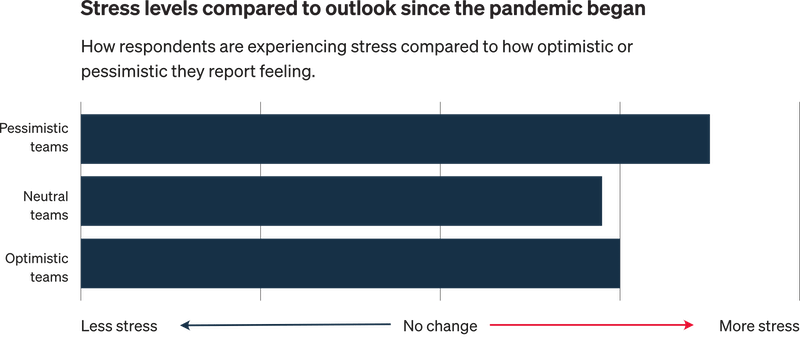

Firms that offered email marketing, ecommerce, and content marketing services tended to have better expectations for the second half of 2020. Firms focusing on B2B services, education, government or public sector, healthcare, financial services, entertainment, or funded startups are more optimistic about the second half of the year. Respondents are stressed, but managers at optimistic firms are absorbing less stress from their team members and experiencing no changes (or an uptick) in productivity.

Patterns of pessimistic digital agencies in 2020

Pessimistic firms surveyed have seen drastic reductions in monthly recurring revenue, uncertainty around contract renewals, and concern over the destabilizing impact of COVID-19. Impacted verticals like tourism, hospitality, charity/not-for-profit, and real estate are generally more pessimistic about the second half of the year. Firms report issues like uncertainty around the outlook of their industry vertical, slowing pipelines, paused projects, and client budgets being cut. They are having to renegotiate project payment terms, failing to raise capital, and expect to cut expenses in the future. Managers at pessimistic firms are more stressed than those at optimistic firms and absorb more stress from their teams.

Click here to see all results.

One agency in the nonprofits, industry organizations, and government speciality category reported that “We went from $250k profit in Q1 to a projected $110k loss in Q2. Haven’t seen enough change to think Q3 and Q4 will rebound enough to give it anything other than 1/5 (for 2nd half of 2020 forecast).” Here are some additional quotes from the report:

Growth tactics & trends among resilient digital agencies in 2020

We looked at how firms were growing their revenue this year and asked about client size and value, profitability, difficulty filling sales pipelines, and closing leads. We also asked managers what tactics they were using to improve lead generation and sales. Here’s what respondents reported:

Even the most optimistic respondents reported having more trouble keeping their pipelines full but the increase in difficulty is much less for optimistic firms than for pessimistic ones. Pessimistic firms that were considerably less confident in their outlook had the same level of difficulty filling their pipeline before the pandemic, but a much more difficult time filling it this quarter.

Two-thirds of firms were focused on upselling current accounts to fill their pipelines, while half were focused on inbound/content marketing to drive leads. The remainder are trying things like cold email outreach and advertising to boost leads. While all firms had a similar focus on upselling and inbound marketing, optimistic firms tended to put more of a focus on cold email outreach to generate leads. Pessimistic firms focused more on upselling current accounts to drive leads than other tactics while optimistic firms relied less on this tactic.

“We want to make sure that digital shops are balancing their revenue channel focus and matching it to how quickly they need revenue. While upselling current accounts is one of the easiest and fastest paths to revenue growth, things like inbound marketing take time to drive meaningful results. From our research, cold outreach is the fastest way to drive business after upselling current accounts.”

-Nicholas Petroski, Managing Director at Promethean Research

The state of cash management among digital agencies in 2020

We asked firms about cash reserves, capital (including type) raised versus intent to raise in the future, and expense reduction. Most firms appear to have enough cash on hand, with a slight skew towards “too little.” Only 11% raised capital in the last few months with only 10% expecting to raise in the next few. Three-quarters of respondents have reduced expenses already and just over half plan to reduce expenses in the next few months.

How digital agencies are handling payments & cancellations in 2020

Firms reported on project cancellations, contract renegotiation, slow-paying accounts, and adjusting payment terms. While most firms have experienced project cancellations, only 35% of respondents noted a breach of agreement, and just under half didn’t ask for anything in exchange for the cancellation. Almost two-thirds of firms are experiencing delays in payment and only a fraction of firms are experiencing a client’s refusal to pay. In response, firms are changing their pricing plans to billing more frequently or getting bigger deposits. Firms that have not yet experienced a cancelation had better outlooks than those that saw all or portions of projects canceled.

Operations and project management

We surveyed firms on their operations and asked about their number of active projects compared to active project managers, whether those projects were on time and on budget, and we asked them about their productivity levels during the pandemic. Optimistic firms appear to have more effective project management systems and they were more likely to deliver projects on time and within budget than more pessimistic firms. Teams who limited active projects to 3–5 per PM also had a better outlook than firms with project managers who ran more than five projects at once. Most firms were just as or more productive during the pandemic than prior to the months leading up to it.

“When you can systemize your project management and avoid splitting your focus, you have better relationships with clients and can complete projects to a higher standard. Plus you can get them launched on time. This should have a positive impact on profitability, but it also lowers the likelihood that you will have to pump your sales pipeline with a higher number of smaller value projects.”

-Rachel Gertz, Digital PM Trainer, Cofounder at Louder Than Ten

We surveyed respondents about remote work policies, company distribution before and after the start of the pandemic, clarity around internal communication, and how effectively teams use their tools. Many of our respondents expect to see distributed work environments remain elevated through the first half of 2021. Those with more optimistic outlooks expect a much more significant increase in remote work (54% growth from pre-pandemic levels) than those with pessimistic outlooks (36% increase from pre-pandemic levels).

Stress management

We asked firms about their stress levels before and after the pandemic and whether respondents have the support networks they need. Pessimistic firms tended to experience slightly more stress than optimistic ones and we found owners with poor outlooks taking on slightly more stress from their teams. A good stress management tactic is to have a community to lean on which most of the respondents noted having. Communities like the Bureau of Digital are perfect options for digital marketing agencies to find support.

Research methodology for The Pattern Report

This survey was conducted between May 19th–May 26th, 2020 three months into the midst of a global coronavirus pandemic and the onset of an American civil rights movement. Approximately 96% of respondents were owners, C-levels, and executives from 84 digital service companies across Canada, the United States of America, Mexico, the United Kingdom, and South Africa.

Almost all respondents were at senior-level management positions within their firms. Of the respondents, most offer web design and development, and the top three industries respondents worked in include government/not-for-profit, business and professional services, and retail and commerce. Two-thirds of respondents were companies with less than 20 employees.

Update! With the world opening back up again, check out these inspiring post-COVID marketing ideas!

About the author

Nicholas Petroski is a cofounder and managing partner at Promethean Research, a boutique research and strategic consultancy firm serving digital agencies, development shops, and design studios. Here he helps growth-oriented shops drive profound growth through the use of research-backed strategic planning.