Advertising is not always the easiest endeavor. We hear it from our customers every day. And one of the biggest pain points we hear among our small business clientele is a sheer lack of healthy modeling. How are my peers and competitors structuring their accounts? In which channels are they allocating spend? Do they have similar goals, and are they experiencing similar roadblocks? Or am I in this alone?

So to give our customers and our broader readership a better idea about where they fit into the big world of online advertising, we decided to put together a report that nailed down the Online Advertising Landscape in 2019. We polled hundreds of WordStream customers about their strategies, the makeup of their businesses and marketing teams, and the unique challenges they face on a day-to-day basis. In this report, we ask questions like:

- What is your biggest roadblock to growing your business?

- In which channels are you spending your advertising budget?

- Which campaign types are you using on Facebook?

- Which ad formats are you using on Facebook?

- What’s your biggest roadblock to optimizing for mobile?

- Do you incorporate video into your advertising strategy?

- And much, much more!

We ended up with tons of online advertising stats around what businesses like yours are doing with their ad budgets this year. This is your definitive look at the Online Advertising Landscape in 2019, in 30 rainbow-colored charts. Let’s dive in!

No time to read the report now? You can download it for later.

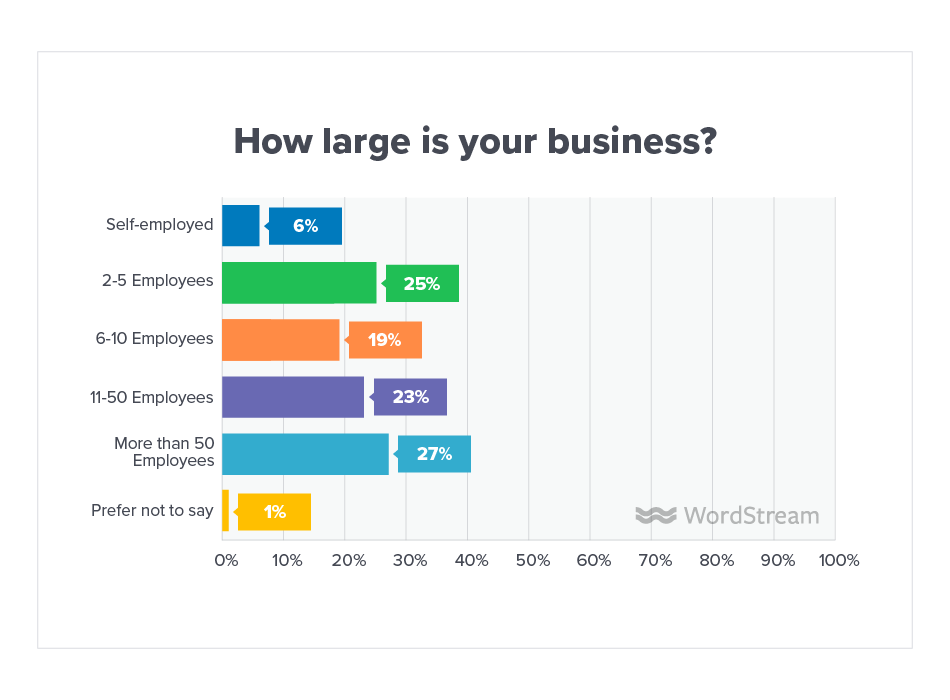

How large is your business?

Context: it’s extremely important! Especially when you’re looking at data. Wondering how relevant the results of our poll are to your unique business? Well, if you’re an advertiser in a company of more than 50 employees, you can safely take much of the data here to heart. 27% of advertisers polled work for businesses with more than 50 employees. That said, the classic WordStream customer—the small to mid-sized business—was also well represented here. 66% of advertisers polled work for businesses with employee numbers ranging between 2 and 50—what we might call the “small enterprise level.”

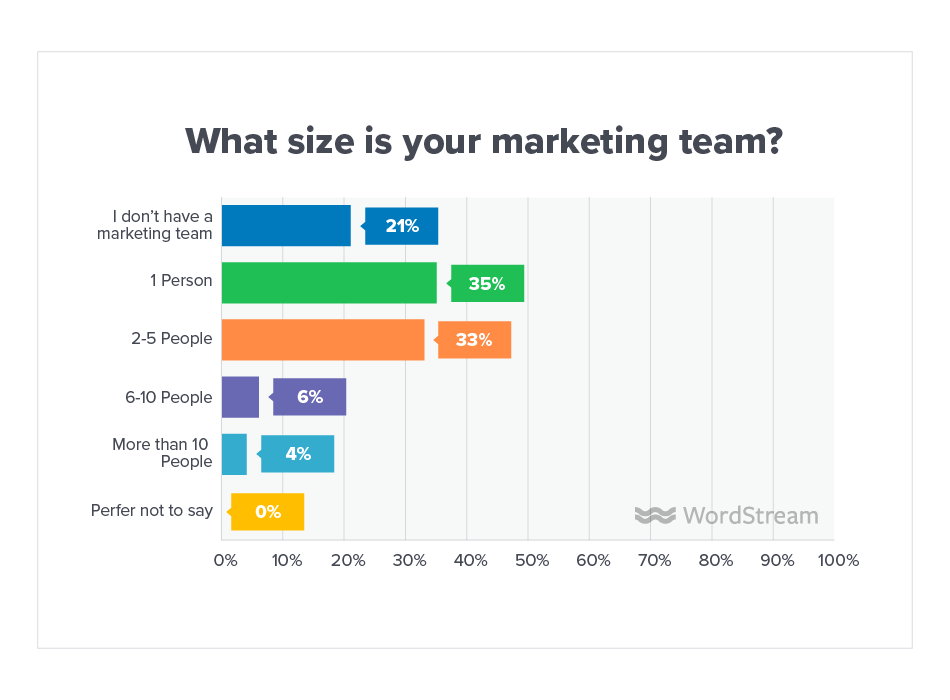

What size is your marketing team?

Let’s get more granular! Business size is one thing—but the size of a given marketing team can make all the difference when you start talking about workflow processes, strategies, and the like. A full 21% of advertisers do not have a dedicated marketing team. That is remarkable when you think about the time and effort that goes into creating sustainable, multi-channel results. Many online advertisers are small business owners that, rather than outsourcing their advertising efforts, have decided to take on the responsibility themselves—an admirable task, but a difficult one given the myriad other tasks business owners face in a given day. The majority of the other advertisers polled (69%) also worked on small teams—teams no larger than 5 people strong.

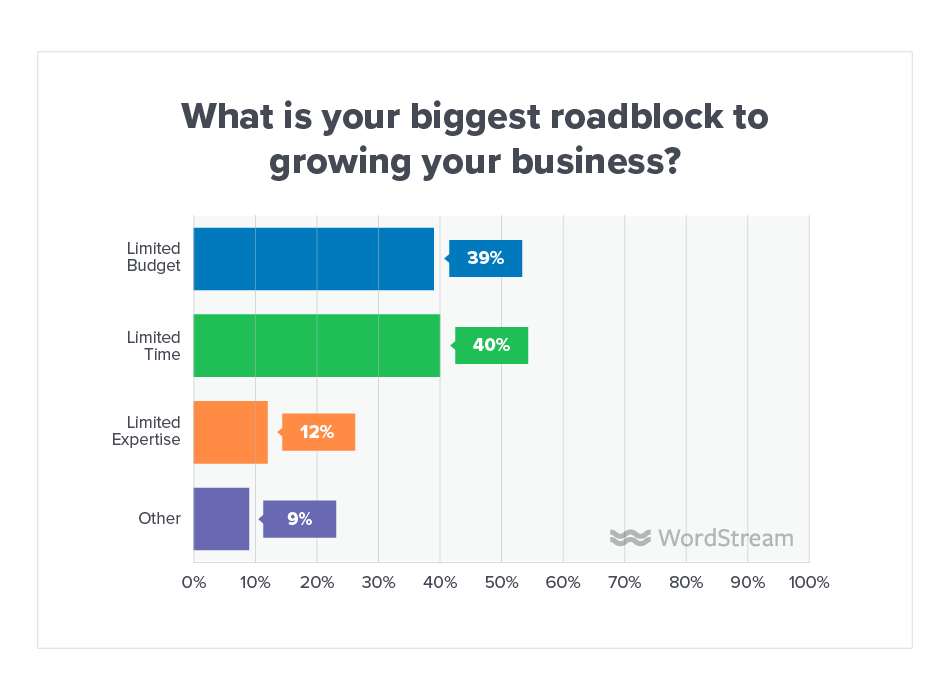

What is your biggest roadblock to growing your business?

There’s only so much time in the day! 39% of advertisers cite limited time as their biggest obstacle to growing their businesses. That’s still 1% less than the amount of advertisers (40%) who say they don’t have the budget to grow their business the way they want to. It’s not too much of a shock, really. Most of the advertisers we talk to feel they have the chops to get the job done; there just simply aren’t enough hours in the day, or enough dollar signs in their budgets. A fact which really highlights the importance of maximizing every dollar of ad spend you have at your disposal.

What is your monthly advertising budget?

29% of advertisers spend between $750 and $2,499 per month on advertising (digital and non-digital channels). That is an encouraging number—to accrue the kind of data you need for remarketing and conversion rate optimization, we typically don’t recommend spending less than $750 per month. Channels like Facebook allow you to generate massive amount of impressions and clicks on the cheap; and channels like the search network typically allow advertisers to make their money back with plenty of interest. So the incentive to spend anything less than $750 per month is pretty low!

For each of the following, please share whether your advertising investment is increasing, decreasing, or staying the same in 2019, as compared to 2018.

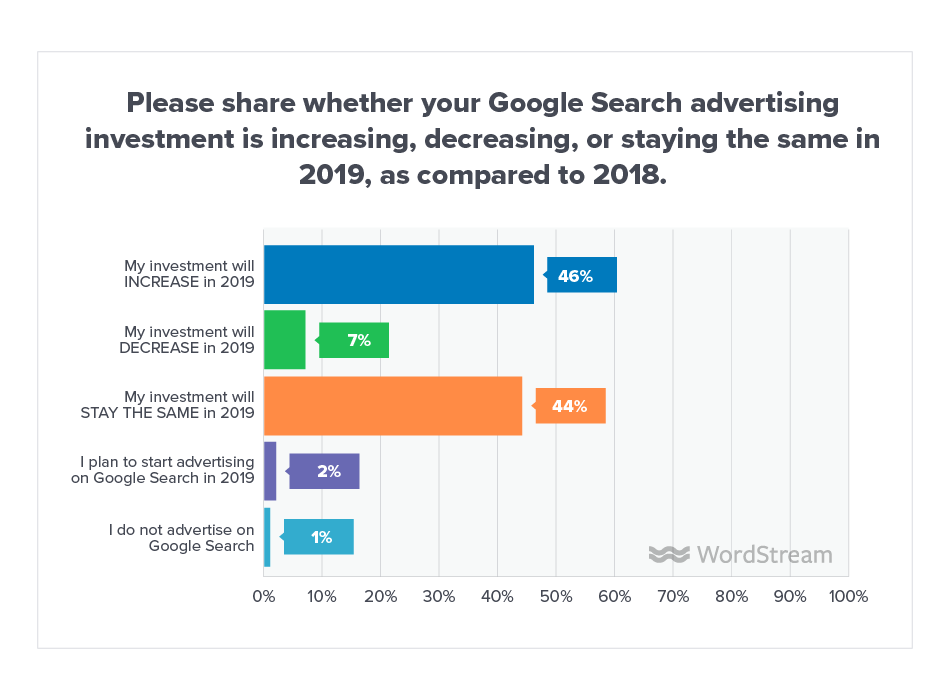

Google Search Network

Just 8% of advertisers are decreasing their advertising investments on Search this year; this compared to a whopping 46% that are increasing them. The point has been made, but you have to spend money to make money. Advertisers may struggle to get ramped up, but once they are spending enough money on the search network to accrue actionable data sets and start optimizing their accounts, they rarely get more conservative with their spend. The upside is, flat out, too huge!

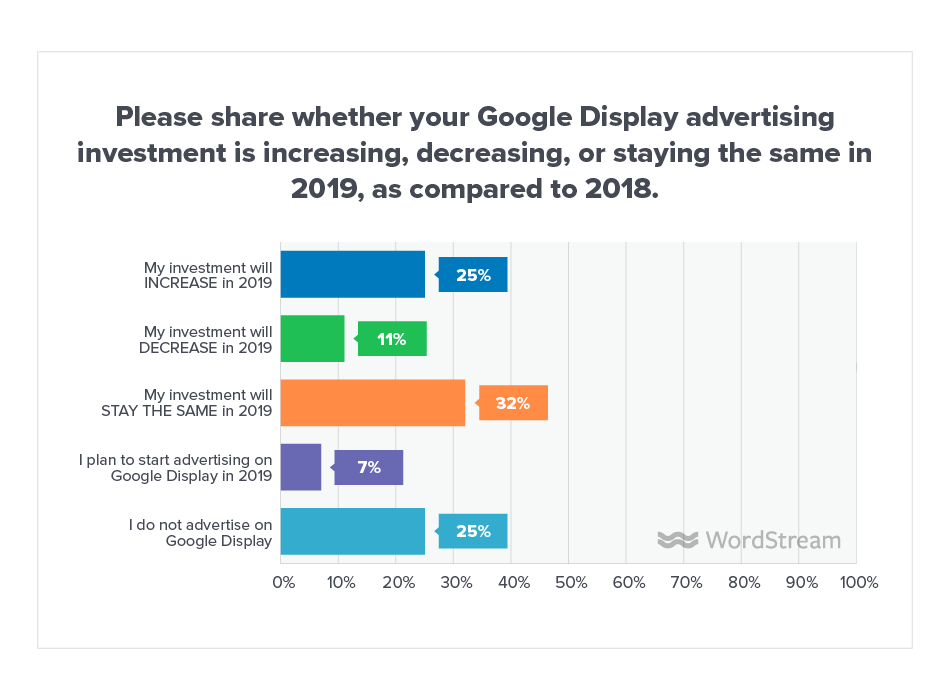

Google Display Network

Spending trends are similar on the display network as they are the search network—most advertisers (57%) are either increasing their investment in display or keeping it the same year over year. Still, about a quarter of advertisers polled (26%) don’t advertise on Display at all. It’s not vitally important that you break into Display—especially if you’re just getting started. I always recommend maximizing your Search budget first if you’re looking to get the biggest return for your spend. But Display does represent an awesome opportunity to build brand awareness at an impressive and cost effective scale—so if you have the budget, and you’re looking to build top-of-funnel awareness, by all means, diversify!

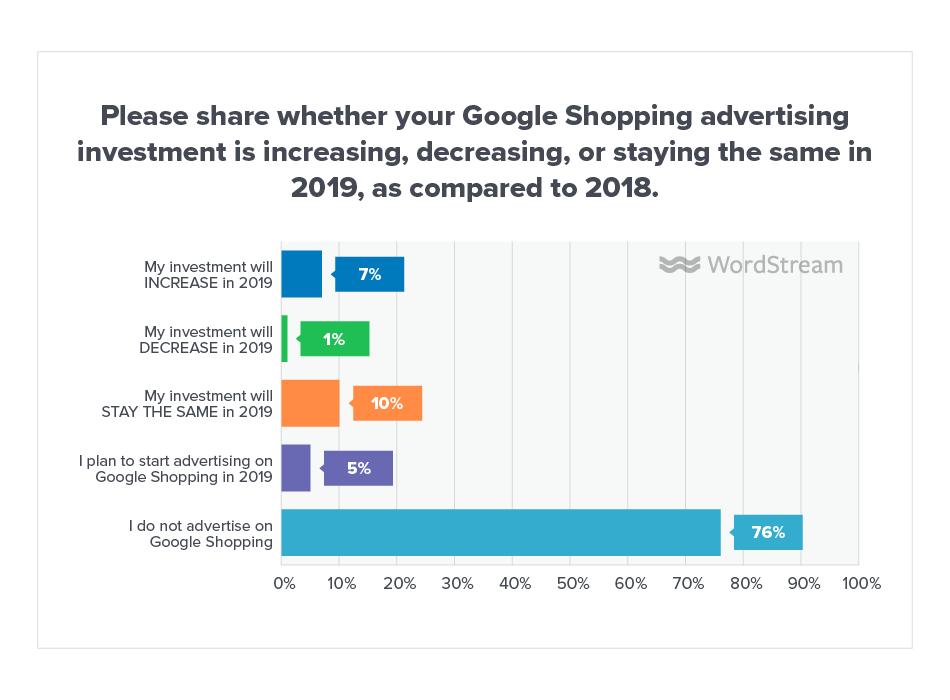

Google Shopping Network

Not all customers polled here work for e-commerce businesses; for those that do, know that Shopping one of the best ways to get qualified traffic to your site. That means attracting visitors that 1. Know exactly what your product looks like (because they’ve seen it in the ad) and 2. Know exactly how much your product costs (because they’ve seen it in the ad)! Note that we’re introducing some exciting new Shopping-related features soon—watch this space.

Bing

Bing doesn’t get a bad rap so much as it doesn’t have one. Well, that’s not entirely true—48% of advertisers polled are advertising on Bing, and plan to either increase their investment next year or keep it the same. 44% do not advertise on Bing and have no plans to do so any time soon. Advertisers in that 44% who exist in competitive niches might want to change their tunes, though—there is, generally speaking, less competition on Bing than there is on Google, and as a result, CPCs are typically cheaper.

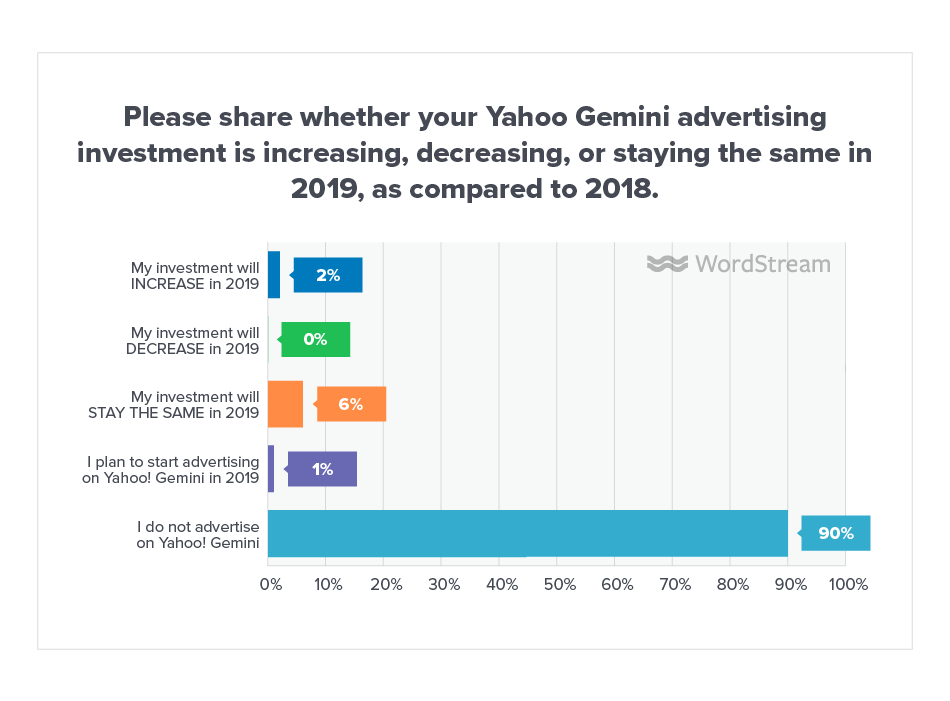

Yahoo! Gemini

Yahoo! Gemini is Yahoo’s self-serve, native ad platform. Not an integral part of your strategy? You’re not alone—91% of advertisers don’t devote, or plan to devote ad spend to this channel. Still: the platform enjoys about 1 billion monthly active users, which puts it on par (for now, at least) with the likes of Instagram—so it’s not exactly a dead zone!

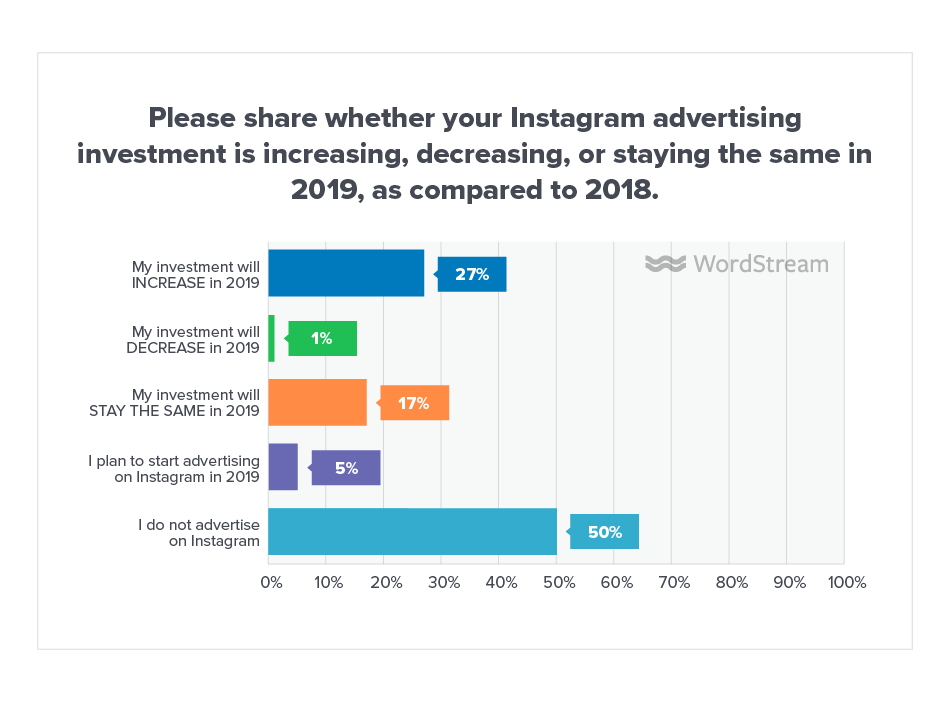

Speaking of everyone’s favorite monster social sharing app—it looks like advertisers are finally coming around on Instagram. Of those polled, 27% of advertisers said they were planning on increasing their Instagram investments in 2019. With new placements like Stories, and with the advent of Instagram shopping, the platform is really ramping up its ad capabilities to match the influx of monthly advertisers flocking to it (2 million is the admittedly out-of-date number floating around). That’s still a tiny percentage of the overall users that are on the platform, so opportunities abound!

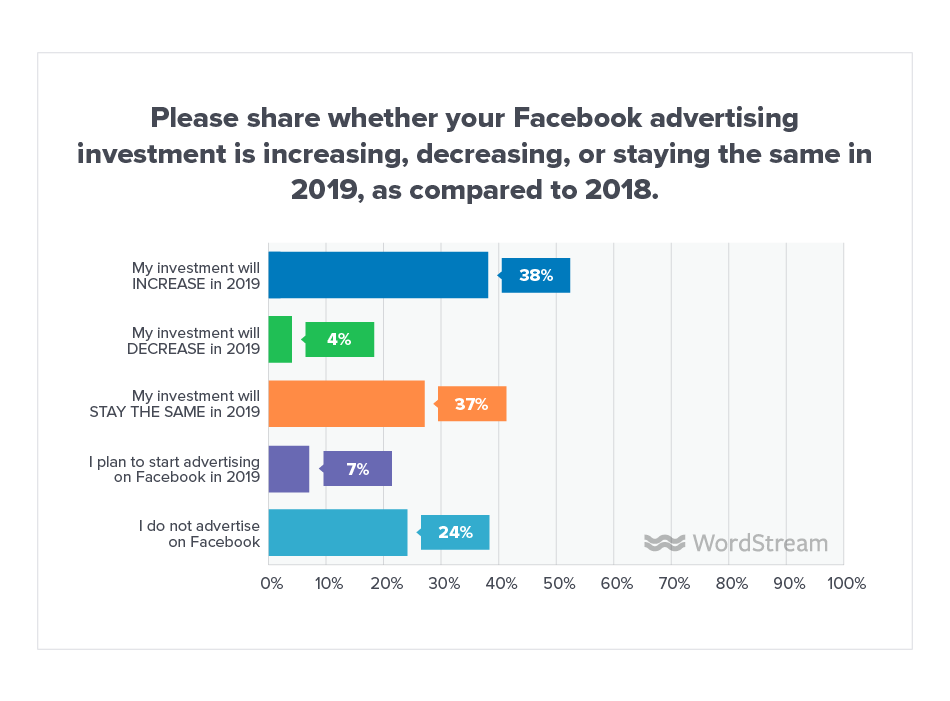

What about Instagram’s parent company? What kind of investment are advertisers making in Facebook Ads? A fairly sizeable one, according to our data. More advertisers (24%) are leaving Facebook out of their strategies than those leaving out, say, the search network; but 28% percent say they will maintain their 2018 investment in 2019; and a good chunk (38%) say they plan on increasing their budgets in 2019. And why wouldn’t they? With a sophisticated suite of targeting options, and myriad placements, Facebook makes the perfect complement to Google.

Amazon

With Amazon seemingly hell bent on taking over…everything, it comes as somewhat of a surprise that more advertisers haven’t adopted Amazon advertising as one of their more prominent strategies. 84% of advertisers don’t currently advertise on Amazon, and have no plans to do so this year. That’s quite a bit of missed opportunity for sellers of tangible products. Amazon enjoys 300 million users, and it’s estimated that 80 million(!) Americans are Amazon Prime members.

YouTube

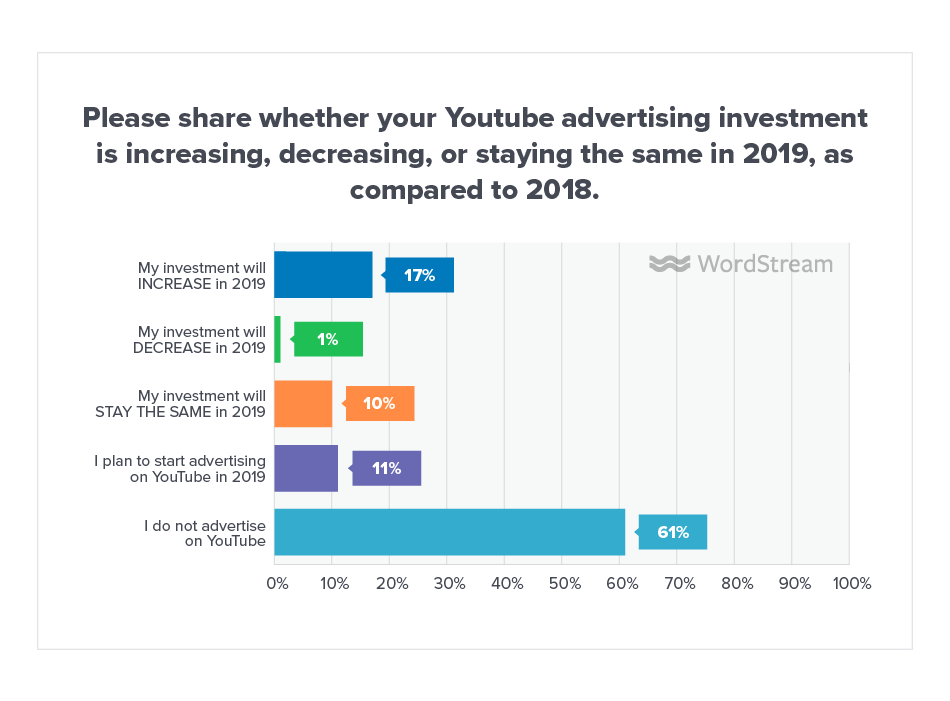

17% of advertisers plan on increasing their investment in YouTube advertising next year—a smart move. With over 1 billion views per day, and with the recent release of TrueView for Shopping, YouTube is a valuable network to showcase your products, reach new prospects, and build new audiences.

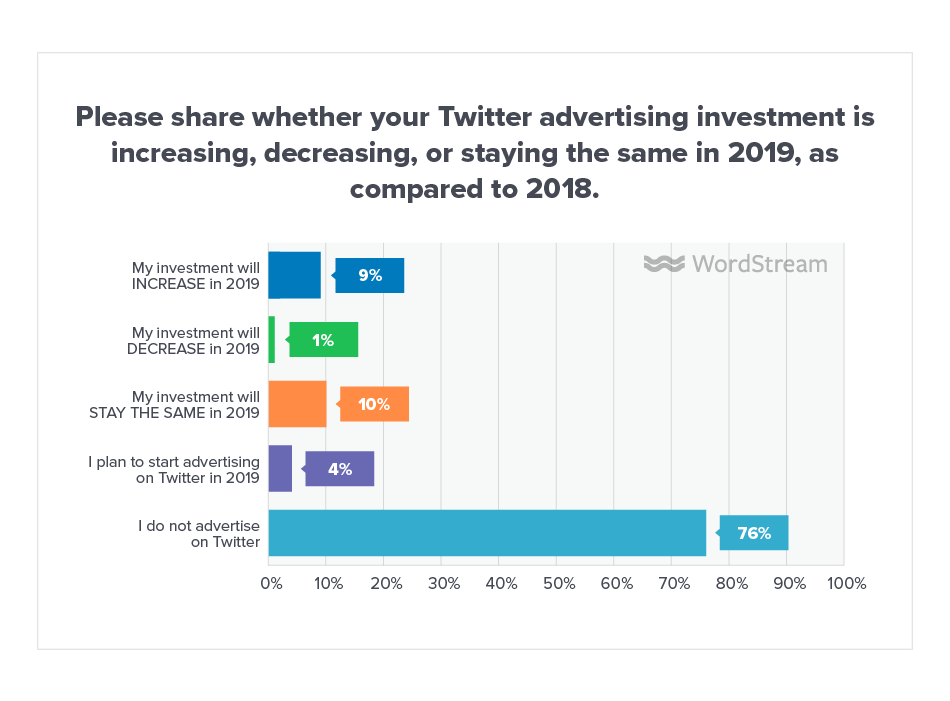

19% of businesses already advertise on Twitter and plan on either maintaining or increasing their Twitter budget this year. If you’re looking to drive profit, Twitter ads aren’t exactly the bee’s knees—but they do represent the potential to generate relatively cost-effective engagement.

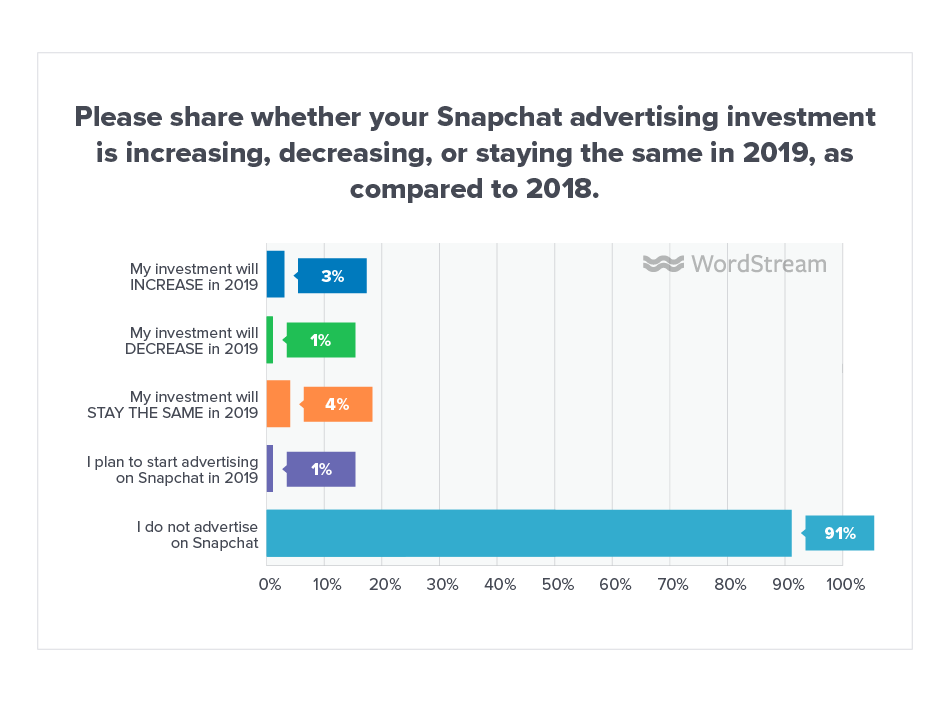

Snapchat

Just 9% of advertisers currently devote, or plan to devote budget to Snapchat—which, despite enjoying just 0.6% of the US digital ad market, can be a useful channel for advertisers trying to target a younger demographic.

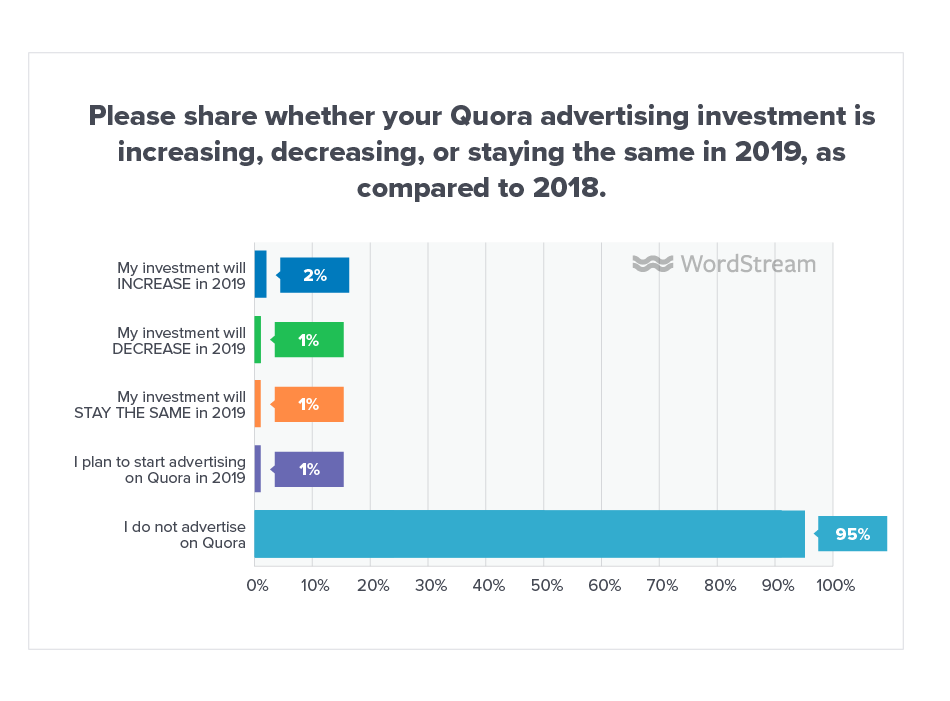

Quora

Quora, which can be a solid channel for growing brand credibility, is one of the least used platforms on this list—95% of advertisers don’t currently leverage, or plan on leveraging it.

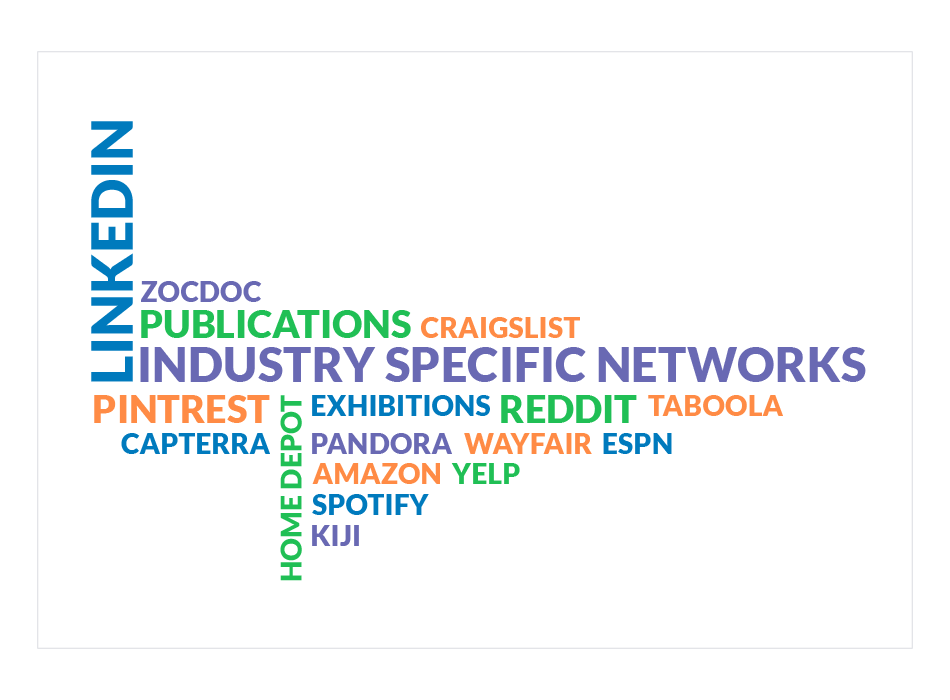

Are you advertising on any other networks? Which ones?

The most common answer here was “no,” but among the other platforms advertisers said they were leveraging, LinkedIn was far and away the most common.

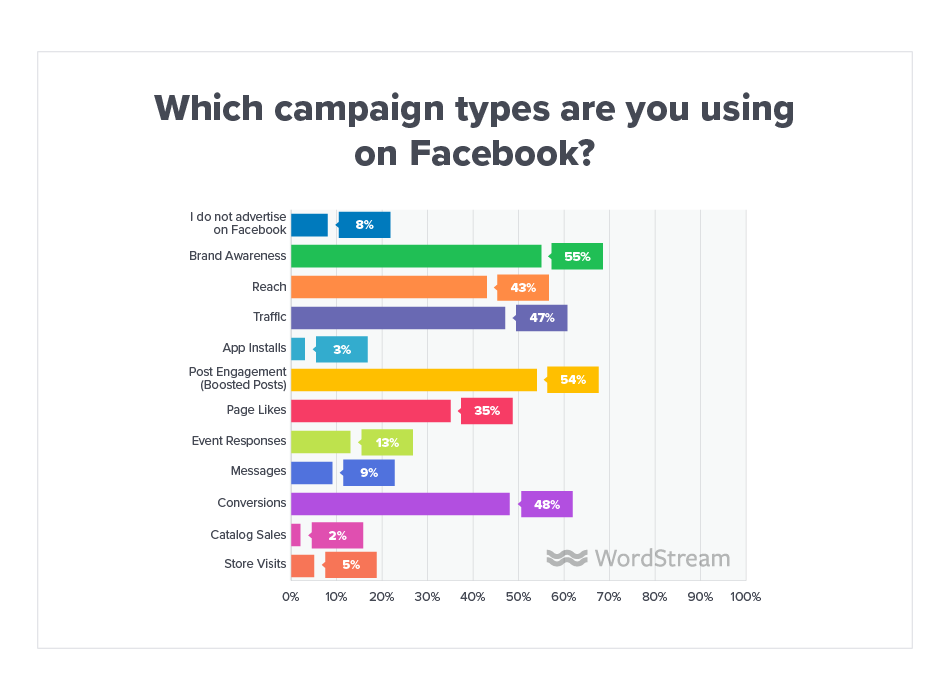

Which campaign types are you using on Facebook?

If you’re among the 76% of advertisers who make or plan to make Facebook a part of their strategies, you’ve used Facebook objectives to select campaign types that allow you to optimize for your marketing goal. There are three objectives total—Awareness, Consideration, and Conversion—and all Facebook campaigns exist within these objectives. Accordingly, these allow advertisers to create campaigns specifically designed to maximize their performance in a given part of their marketing funnel.

Which campaigns types are advertisers using the most? The most-used campaign type among all Facebook campaigns is Brand Awareness—55% of advertisers leverage Brand Awareness campaigns to drive impressions at a widespread and cost-efficient clip. Post Engagement (54%), Conversions (48%), Traffic (47%), and Reach (43%) are not far behind, though; which suggests that, smartly, advertisers are using Facebook to not only complement Google, but as a full-funnel channel in its own right.

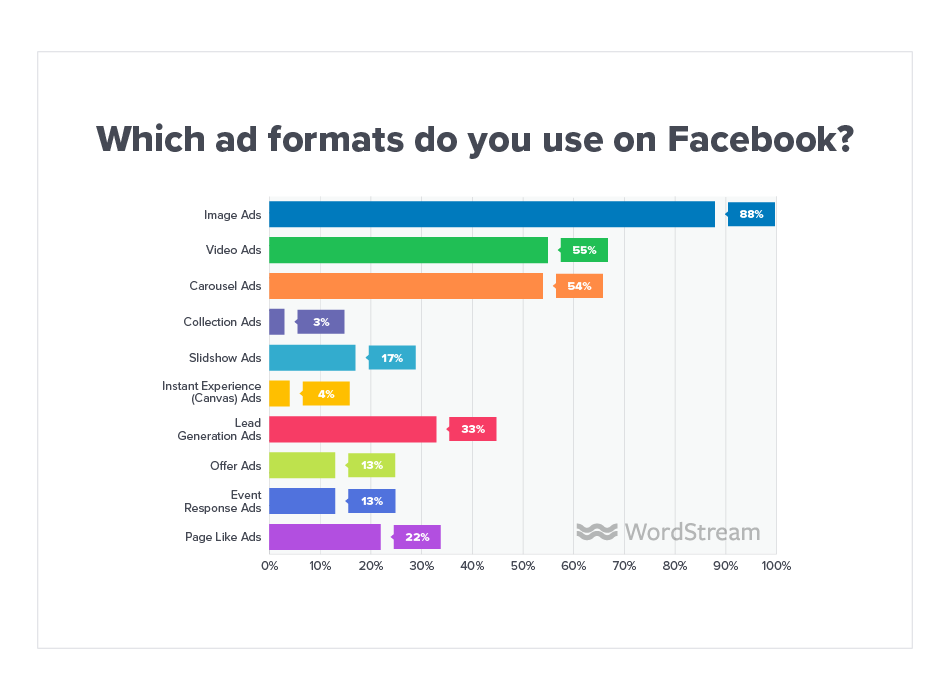

Which ad formats do you use on Facebook?

As might be expected, image ads reign supreme on Facebook. 88% of Facebook advertisers use image ads in some capacity. 55% of Facebook advertisers use Video ads (nothing to sneeze at), while just 4% of advertisers use Canvas ads. This is not overly surprising, given the time and effort it takes to create Facebook canvases; and we were fairly impressed that more than half of advertisers are leveraging video in some capacity in their Facebook strategies. Animated creative is super important! What did surprise us was that only 33% of Facebook advertisers use Facebook lead ads. Again, this survey was not limited to lead gen-specific businesses, but lead ads are an extremely useful ad format, and we believe they’ll enjoy more ubiquity in the near future.

Please rank the following marketing strategies in order of importance to your business.

Unsurprisingly, advertisers ranked paid search as their single most important marketing strategy, giving it an average position of 1.58 out of six strategies—paid search, content marketing, paid social, email marketing, display, and shopping cart/data feed management. Content marketing (3.12) somewhat surprisingly beat out paid social (3.13) and email marketing (3.66), both of which are typically more associated with revenue. But content marketing can pay serious dividends in the long-term, so we’re glad to see marketers investing in it!

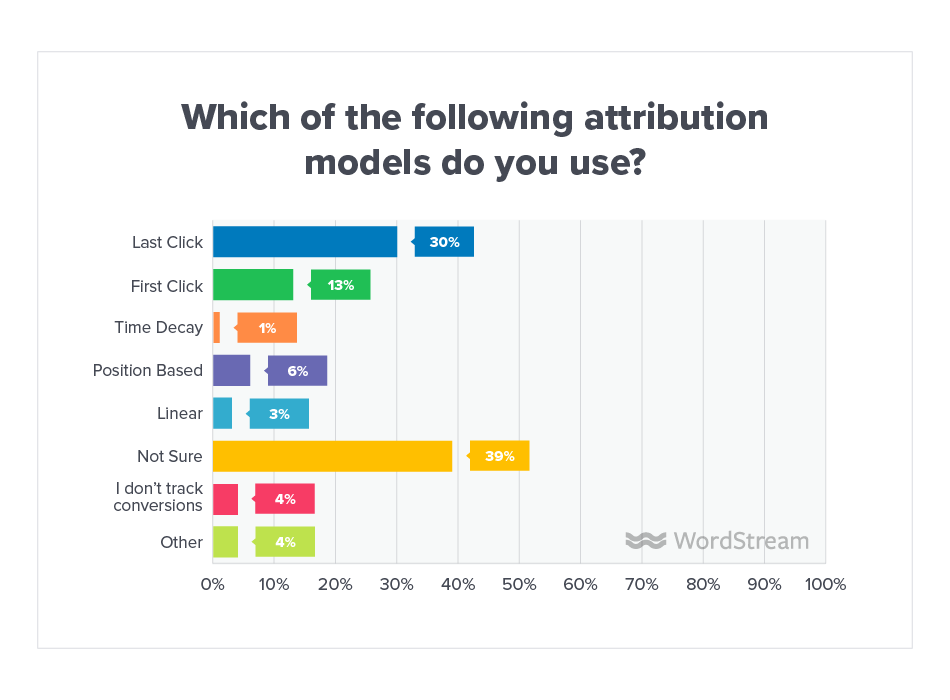

Which of the following attribution models do you use?

Last-click attribution, a model which gives credit to the very last click that drove someone to your website before they converted, is Google’s default attribution model. It’s also the model most used among advertisers who are “sure” which model they’re using (31%). We’d be willing the guess that many among the 38% who aren’t sure are also using last-click attribution. If you are using last-click attribution, and you find that you’re seeing a lot of value in branded campaigns and less value elsewhere, there are several worthwhile alternative models you might want to consider.

Rank the following advertising objectives in order of importance to your business.

No surprise here—cash is king! Advertisers named increasing ROI/ROAS as the most important advertising objective to their business, followed closely by three more profit/revenue-centric objectives—conversion rate optimization (CRO), increasing conversion volume, and conversion tracking. The further up the funnel the objective, generally speaking, the less important that object is for advertisers.

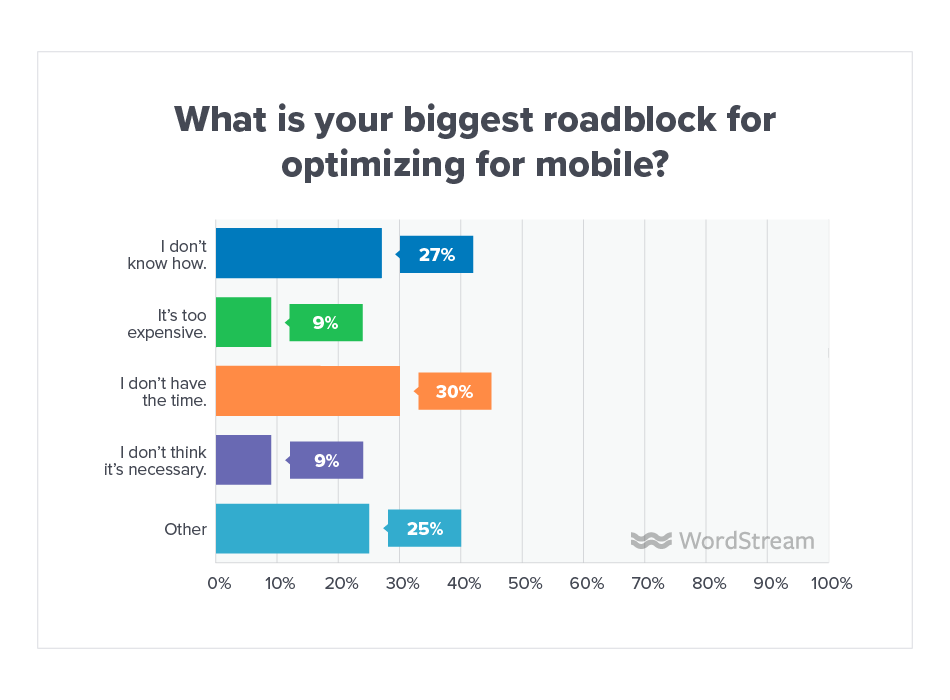

What’s your biggest roadblock for optimizing for mobile?

31% of advertisers said they don’t have time to optimize for mobile. Given the importance of optimizing for an increasingly mobile-centric universe, that’s a huge number! Not only is mobile speed now a ranking factor, but 52.2% of all traffic globally comes from mobile.

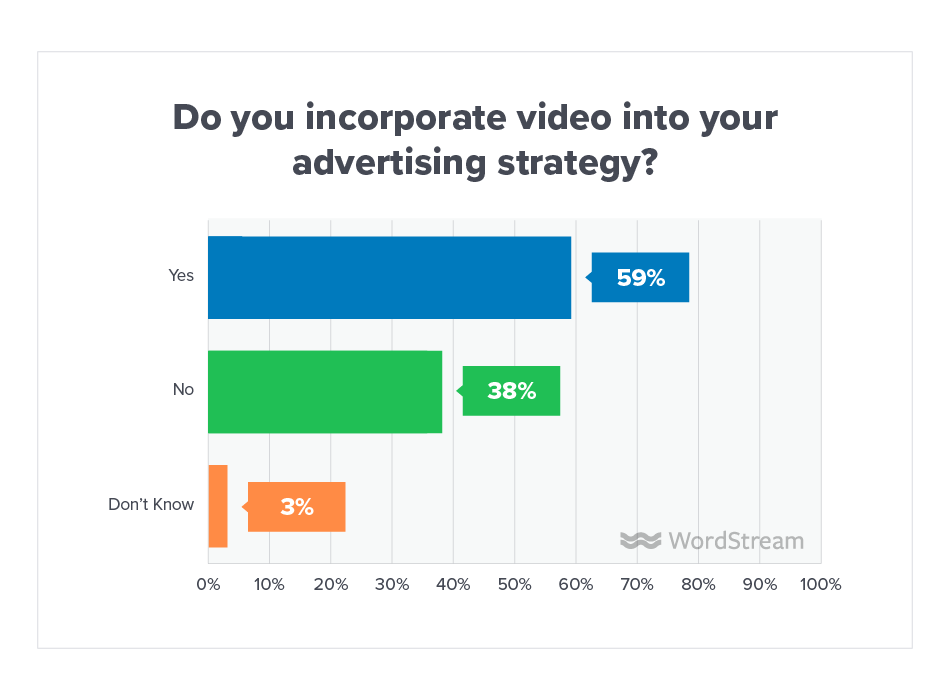

Do you incorporate video into your advertising strategy?

60% of advertisers are actively working video into their advertising strategies. If we ran this poll two years ago, we’d be willing to wager that number would be markedly lower. Video is becoming an ever-more prominent part of marketing—mostly by necessity. More and more competitors are leveraging video across channels, so brands can no longer afford to work exclusively with static creative and expect to keep up.

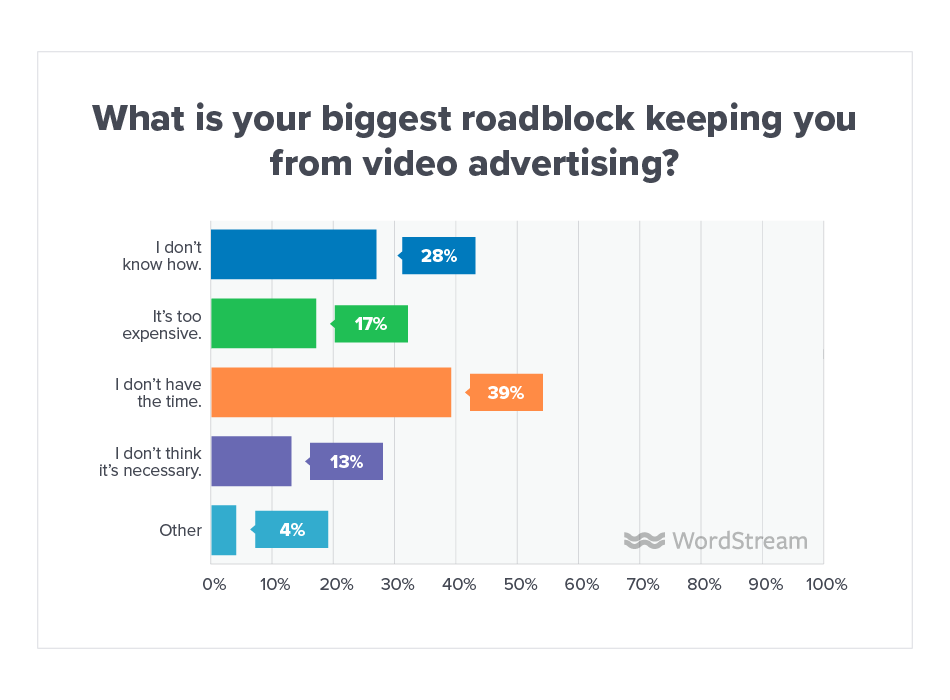

What is your biggest roadblock keeping you from video advertising?

Time and expertise are the two biggest factors keeping advertisers from working video into their advertising strategies. 38% of advertisers said they simply don’t have the time to invest in video, while 28% said that they simply don’t know how. With plenty of solutions now available to make video ad production easier than ever, however—take WordStream’s Smart Ads, for example—we should see these numbers continue to decrease in the coming years.

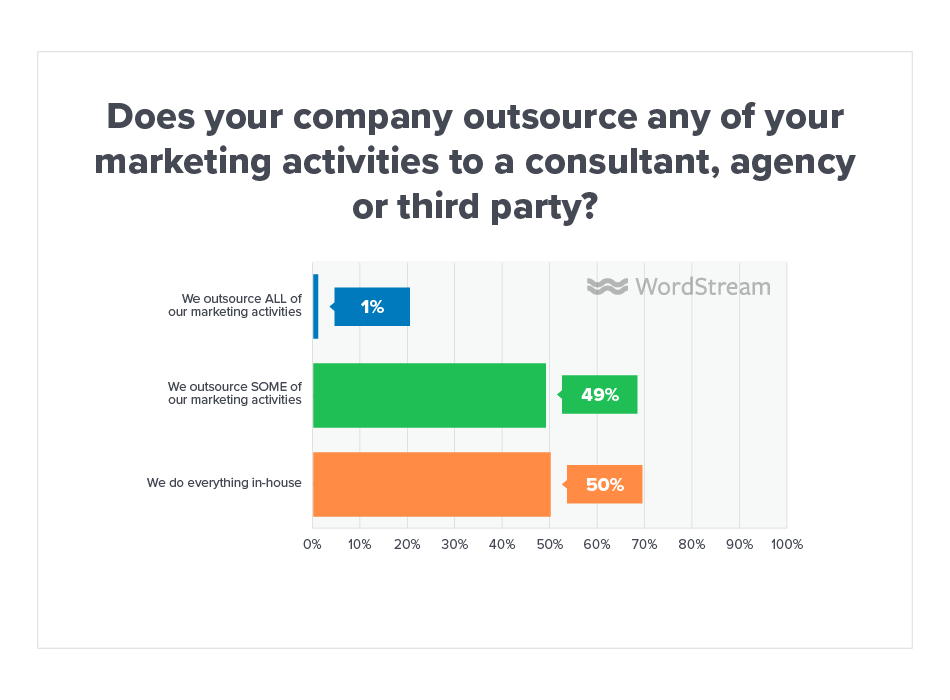

Does your company outsource any of your marketing activities to a consultant, agency, or third party?

Even split here! Hiring a knowledgeable consultant can work wonders for your bottom line. It can also save you a boatload of implementation time. Interestingly, slightly more advertisers prefer to go the DIY route (50%) than outsource work to consultants and agencies.

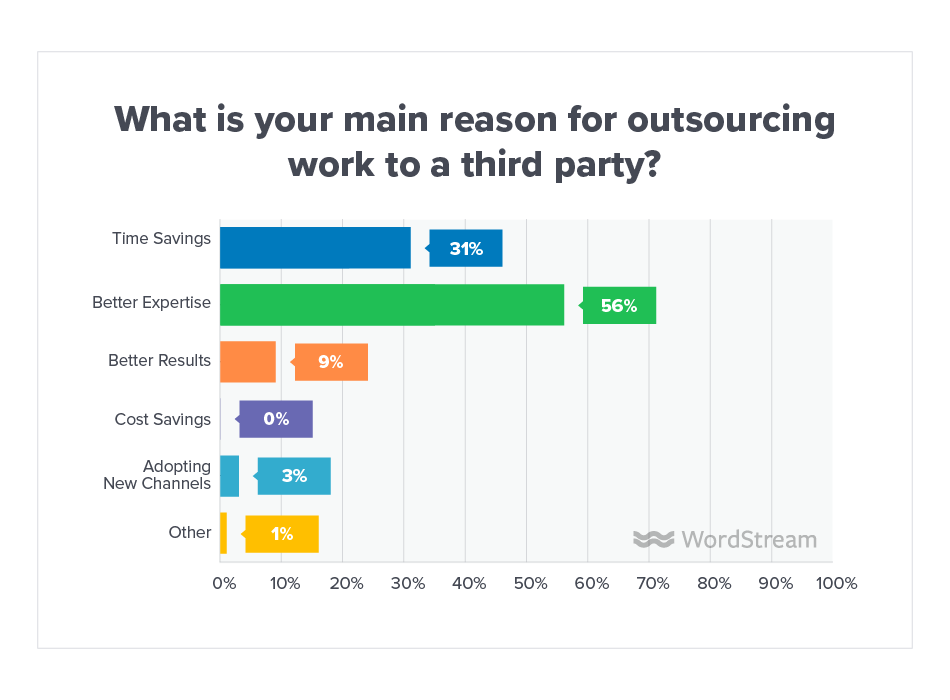

What is your main reason for outsourcing work to a third party?

Of the advertisers outsourcing work to third party agencies and consultants, 31% did so to save time, while 55% did so because they felt they could get better expertise out-of-house.

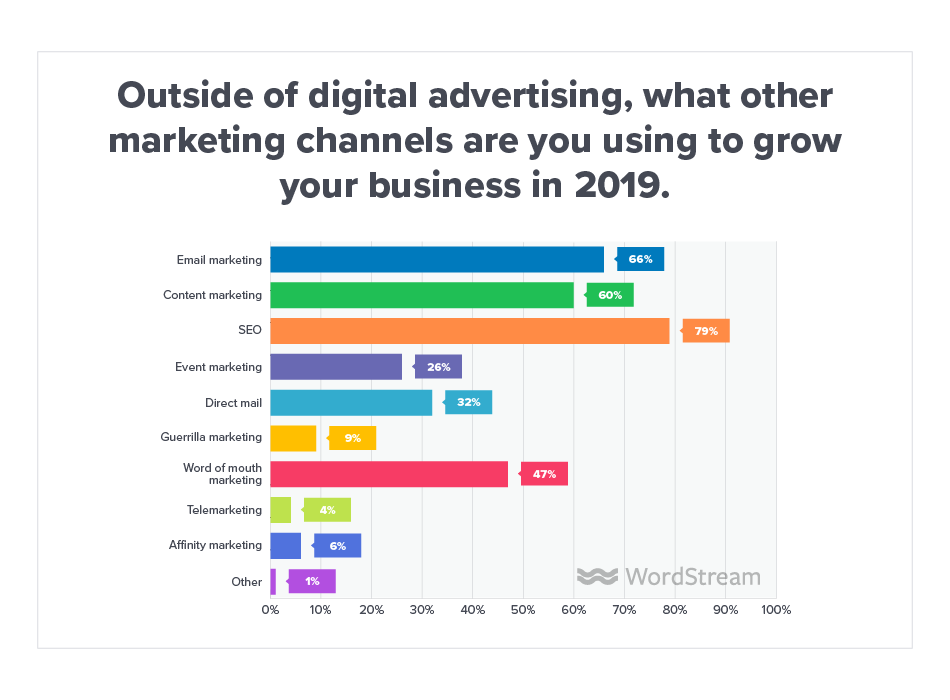

Outside of digital advertising, what other marketing channels are you using to grow your business in 2019?

79% of advertisers also plan on investing in SEO to grow their businesses in 2019. Like content marketing, SEO can be an extremely valuable long-term strategy when done effectively. A lot of advertisers prioritize paid search over organic search because of the potential for immediate profit. Kudos to those surveyed for recognizing the importance of balancing short-term results with a long-term strategy for sustainable growth!

What other tools are in your marketing stack?

Tracking is vital! Nearly all (95%) of advertisers use Google Analytics in some capacity to collect and sift through data. SEO tools like Moz (16%) and SEMrush (24%) also enjoyed decent usage, while a solid third of advertisers (33%) said Mailchimp was a part of their marketing stack.

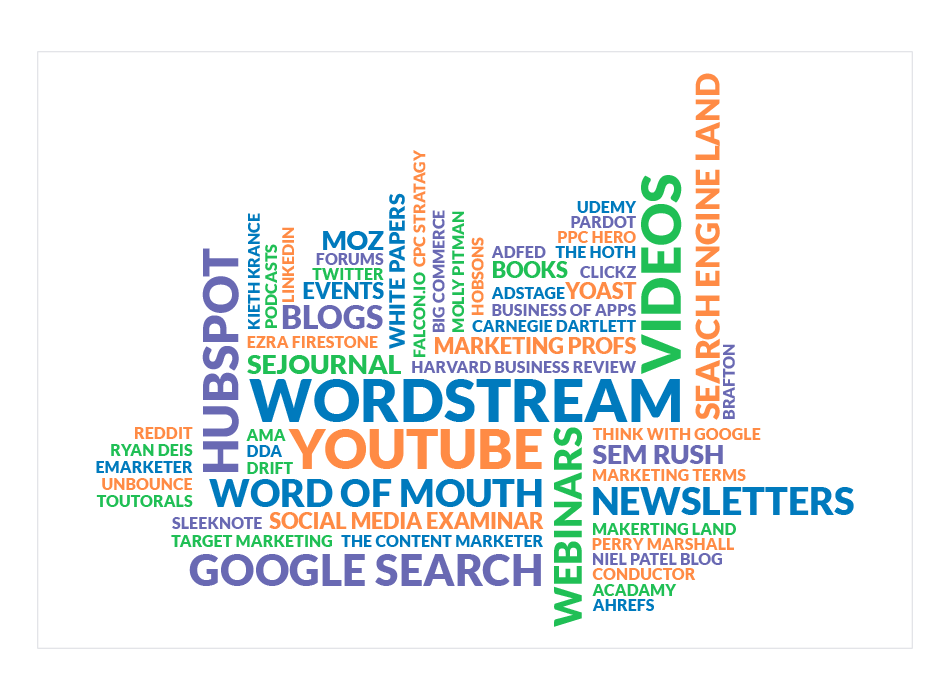

What are you favorites resources for learning about marketing and advertising?

Shout out to those surveyed for giving the WordStream blog a lot of love in this section. HubSpot, Social Media Examiner, and Search Engine Journal were also named frequently here; and in terms of format, those surveyed frequently named video as their preferred way of consuming educational marketing content.

Actionable takeaways

- Time limitations are the number one challenge for all types of advertisers

- Almost half of advertisers are increasing their investment in Google search ads this year

- A quarter of advertisers don’t use display at all—a huge missed opportunity!

- Almost a third of advertisers are increasing their investment in Instagram this year

- Half of advertisers do everything in house—no wonder you’re so busy!

- Tons of advertisers are experimenting with LinkedIn as an advertising channel

- Facebook advertisers are leveraging several campaign objectives as part of a full-funnel strategy

- Returning a profit is far and away the most important goal for advertisers

Click here to download the full report as a .pdf.

Stay tuned for next year!

That about does it! We hope you learned a thing or two about the online advertising landscape in 2019, and will use some of the data included here to adjust your advertising strategy accordingly. We’re very much looking forward to seeing how this data changes over time, so stay tuned for next year’s Online Advertising Landscape. Until then, happy advertising, and be sure to check out the WordStream blog for the latest trends and strategies from the world of online advertising.

![Search Advertising Benchmarks for Your Industry [Report]](https://www.wordstream.com/wp-content/uploads/2024/04/RecRead-Guide-Google-Benchmarks.webp)