We write a lot about metrics on the WordStream blog. From click-through rate (CTR) to conversion rate (CVR) to return on investment (ROI)—if it’s measurable, and it can help you better understand the performance of your online advertising campaigns, we have the goods!

Today, we want to talk about a couple metrics that, while related to advertising performance, are not necessarily advertising specific and are meant to help you better understand performance at a business level. Customer acquisition cost (CAC) and customer lifetime value (CLV) are two distinct yet equally pivotal metrics. Let’s discuss why they’re important, how they differ, how they’re related, and how you can calculate each.

Customer acquisition cost (CAC) meaning and definition

Customer acquisition cost (CAC), as you might gather from the name, is the cost of converting a prospect or convincing a potential customer to become an actual customer. If this sounds a little like cost per action or acquisition (CPA), don’t worry, you’re not going crazy—the two are related but not the same. You can separate the two in your mind by thinking about CPA as a campaign-level metric, and CAC as a more overarching, business-level metric. CAC encompasses the cost of acquiring business across all your marketing efforts—online and offline, billboards and media placements, Google Ads and Facebook ads, even the cost of a store-front sign.

Also keep in mind that your CPA is not the same as your cost per conversion. If you’re running a lead gen business, an “action” in one of your Google Ads campaigns might be a content download, a webinar registration, a phone call, some other conversion action that is not actually a prospect becoming a customer. If you’re an ecommerce business, your CPA for a given campaign might very well be the cost of enticing a prospect to click through to your online store and then buy something.

How to calculate customer acquisition cost

Calculating CAC is a matter of dividing your overall marketing expenses by the number of net new customers acquired in a given period of time. Because of the varying degrees of effectiveness of different marketing channels, it’s helpful to resist the temptation to bundle up all your expenses into one universal CAC calculation—and not only because doing so will give you a muddled perception of how much it costs to convert your prospects. It’s also because segmenting your CAC calculations by channel will allow you to determine which channels are most effective and how specific channels increase or decrease in effectiveness over time.

SEO is a prime example of this. Lumping in SEO and content marketing, which are longer-term marketing strategies, with Google and Facebook advertising when calculating your business-wide CAC is going to give you an artificially enhanced understanding of your overall SEO performance and a watered-down understanding of performance in your online advertising channels. Why? Because SEO and content marketing typically take longer to yield results.

Still, your SEO CAC may very well be lower than that of your advertising channels over time—and that is why it’s helpful to calculate channel-specific CACs. For instance, you might outsource four blog posts to a freelancer per month for $100 each. Let’s say you’re looking just at conversions you can tie directly to those blog posts. (So you’re not including conversions that may come as a result of remarketing or of a blog visitor leaving your site and then returning later to convert by means of their own volition.) Let’s say those four blog posts yield you four direct conversions. And let’s say, to save yourself some money, you set the blog posts up yourself and made sure to optimize the meta tags, add internal links, and add the URLs to your sitemap yourself. If that’s the case, and that’s all the effort you put into SEO and content marketing that month, your CAC for that channel is going to be $100 ($400 divided by four new converted customers) for the month.

Blogging is a great way to reduce your business-wide CAC over time

If after a year you’re still paying for four blog posts per month at $100 a pop, and making all other optimizations yourself, your CAC is likely going to be lower than it was at the start. Why? Because the authority your website has increased, allowing your new posts to rank higher in the index to start, so they’re getting more traffic and driving more direct conversions. And those first four blog posts you outsourced? They’re still published, still in the index, and, if they’re evergreen, still driving traffic and conversions. Therefore, you’re getting more conversions for the same amount of work per month. It’s a bit like compound interest.

You can lower your customer acquisition cost in your paid channels as well if you’re optimizing your campaigns regularly—most likely not at the same scale, but that is why you want to be keeping track. You may find that there are certain channels you can optimize on your own and certain where you’re having trouble moving the needle.

Customer acquisition cost formula: Does it exist?

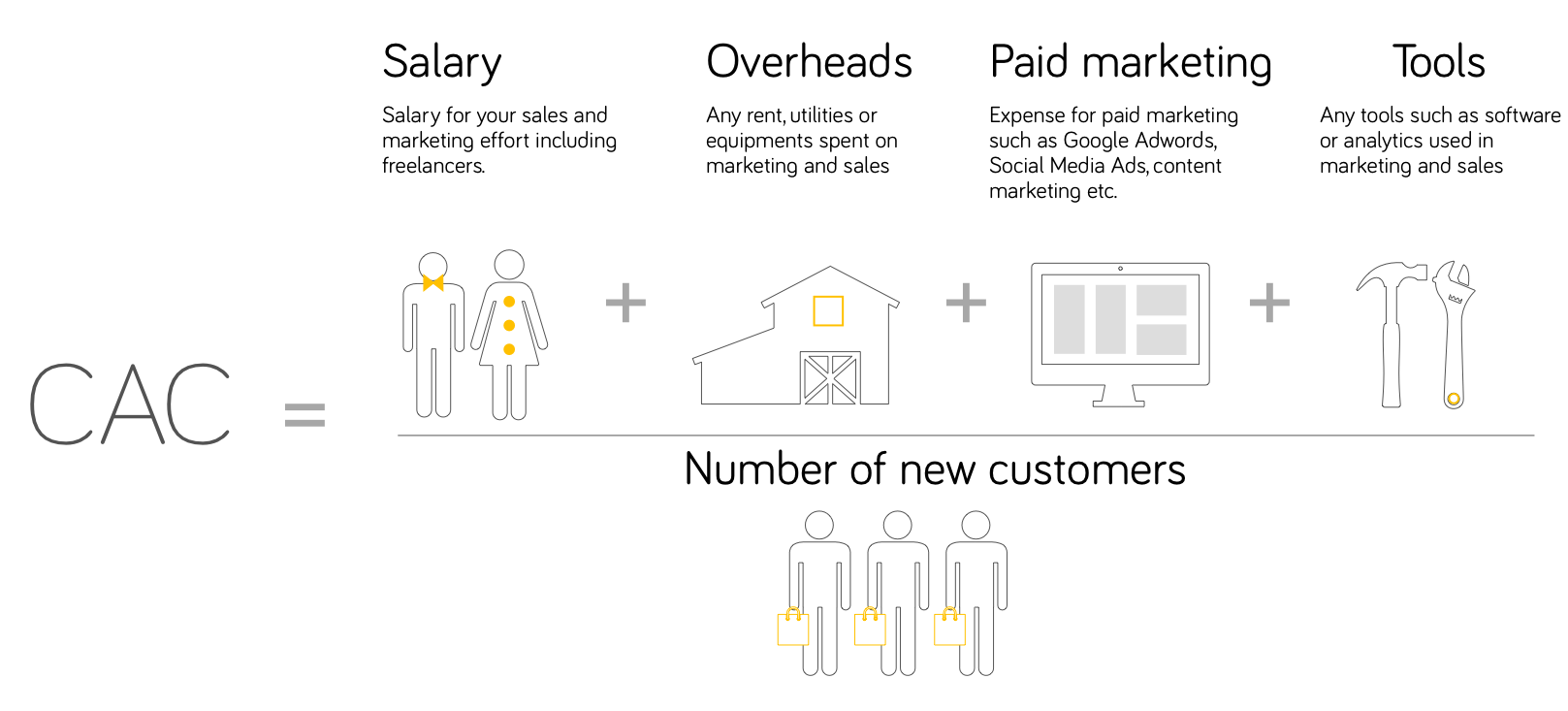

You might find yourself in a position where you have to present stakeholders with a single CAC number for all your marketing efforts. And not just the marketing collateral itself, but the humans behind the marketing collateral and the costs associated with keeping them employed. We kept the SEO example small for the sake of simplicity—you’re dealing with one freelancer and no other operating expenses—but what happens when you start taking into account the costs associated with running an entire marketing team?

That’s right—salaries, overhead, tools, these are all things you should take into account when calculating CAC on a macro level. The reason there is no one hard-and-fast formula for CAC, and we have to keep it vaguely as…

“Costs associated with acquiring new customers divided by number of customers acquired”

…is that CAC is a malleable metric, and you can use it to glean insights for a variety of different parameters. Taking a more granular approach is helpful to get a handle on where you can improve, but you might decide to scale the scope of your CAC calculation up or down depending on what aspects of your business you’re trying to evaluate. Do you need a sales team to convert prospects? What kind of paid tools is your marketing team using? How much of your rent and equipment is allocated to the sales and marketing teams? What’s the cost associated with keeping your online store functional month-to-month? There are tons of costs to consider, but if you’re a business owner, especially a small business owner, you’re most likely intimately acquainted with them all.

Customer lifetime value (CLV) meaning and definition

As a metric, CAC can be a little deceiving—not only, as we discussed, because there are a number of different costs you can choose to take into account, but also because there is a specific profit associated with each customer and often that profit comprises more than a one-off sale. While CAC is important, it doesn’t tell the whole story. That’s where customer lifetime value (CLV) comes in.

Three of the most important functions of customer marketing are retention, cross-selling, and upselling. If your product is subscription-based, you want to make sure your customers are retaining that subscription for as long as possible. If you have multiple service offerings, you might dedicate some of your resources to getting existing customers to diversify into some of those other offerings. If there are “basic” and “more robust” versions of your product, you might be interested in trying to upsell existing “basic” customers to the “more robust,” more expensive version of your product.

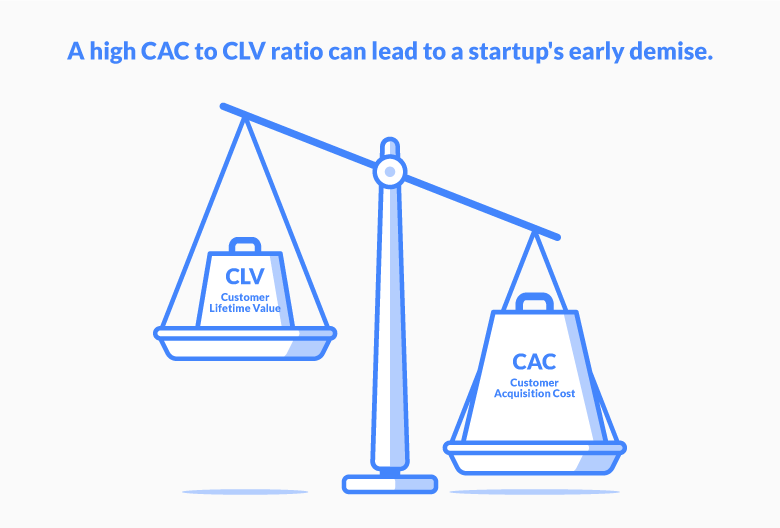

All of these factors play a role in determining your average CLV. One important thing to remember is that CAC plays a role in the CLV equation—they’re not mathematically disparate. Let’s take a look at the relationship between CAC and CLV and how you can use one to calculate the other.

The relationship between CAC and CLV

Naturally, you’re looking for an inverse relationship between your CAC and your CLV, with your CLV being the higher of the two numbers. The less it costs you to acquire a single customer and the more overall value that customer represents, the more profit you stand to make. Rather than look for a stark discrepancy right off the bat, though, a more productive method is to establish the two numbers, use that as a baseline, and then work to push them apart over time. Allowing that margin to get too slim can result in some serious stability issues.

A simple formula for calculating CLV is this:

“Annual revenue per customer times customer relationship in years minus customer acquisition cost.”

Standard practice is to subtract the initial cost of acquiring the customer, so don’t forget to include that in the equation. Doing so allows you to track profit (the amount you take home) rather than just revenue (the amount you make).

Like CAC, CLV is not monolithic. It’s a good idea to calculate one overarching CLV for your business, but you might also want to segment your calculations based on your customer base. For instance, you might have one CLV for the “basic” iteration of the product we were talking about earlier and one CLV for the “more robust” version. Doing so (segmenting CLV calculations based on your customer base), like segmenting via channel when you’re calculating your CAC, will allow you to track value over time and focus not only on which products are providing your business with the most value, but also the ones that are dragging down your overall CLV and can be improved. What is keeping that number low? Is the cost of acquisition too high? Is it an issue of retention caused by product dysfunction? These are the questions you will start to ask yourself after you make your baseline calculations.

CLV and CAC: Which is more important?

So now that we understand the relationship between CLV and CAC and how to calculate both, which reigns supreme?

The fact is that both metrics are vital and both tell a distinct yet not unrelated story about how effectively your business is being run, where you’re losing money, and where you can improve. CLV is perhaps the more coveted metric because it helps you understand bottom line profit, but, as we discussed, you can’t know your CLV unless you know how much it costs to acquire a customer. Use these metrics in tandem to generate a more holistic understanding of performance—and remember, don’t be afraid to break each out into more granular measurements of specific parts of your business.