Whatever you call it – defection, attrition, turnover – customer churn is a painful reality that all businesses have to deal with. Even the largest and most successful companies suffer from customer churn, and understanding what causes formerly loyal customers to abandon ship is crucial to lasting, sustainable business growth.

In today’s post, we’re going to look at what customer churn is, what constitutes a “good” churn rate, and ways you can stop your customers turning their backs on you forever.

Art installation by Tim Etchells

What is Customer Churn?

Client churn is when existing customers stop doing business with you. This can mean different things depending on the nature of your business. Examples include:

- Cancelation of a subscription

- Closure of an account

- Non-renewal of a contract or service agreement

- Consumer decision to shop at another store/use another service provider

Before you can figure out what your churn rate is, you need to decide how you’re going to quantify actions such as those above and agree on what defines customer attrition for your business. Once you’ve done this, you can hit the books and do the math.

Calculating Customer Churn Rate

You can measure your client churn rate in one or more of the following ways:

- Total number of customers lost during a specific period

- Percentage of customers lost during a specific period

- Recurring business value lost

- Percentage of recurring value lost

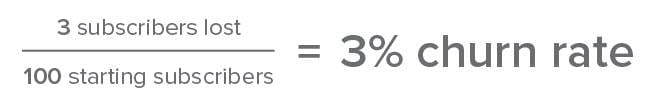

Let’s look at this example from Churn-Rate.com, in which your company has 100 subscribers at the beginning of the month:

You could also choose to calculate your churn rate based on how many subscribers you had at the end of the month, rather than the beginning:

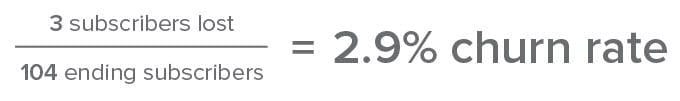

You can also calculate customer churn based on revenue. Businesses that take this approach typically use monthly reoccurring revenue (MRR) as a baseline figure. Now bear with me, because the math gets a little more complicated when calculating client churn using MRR.

In the following example, a company had $500,000 of MRR at the beginning of the month, and $450,000 at the end. Now, let’s say that the company brought in $65,000 from existing customers who purchased upgrades that same month. The churn calculation looks like this:

As you can see, the churn rate is negative – meaning that the company actually ended up making money despite the $50,000 loss in MRR. This is known as negative churn.

However you choose to calculate it, customer churn hurts – a lot. So grab your Kleenex, wipe away those tears, and let’s look at “good” churn rates and how you can lower yours.

What Is a Good Customer Churn Rate?

In an ideal world (one in which customers never complained, cats and dogs lived together in peace and harmony, and nobody ever posted “Game of Thrones” spoilers on Facebook), the perfect client churn rate would be zero.

Unfortunately, this is not going to happen. No matter how excellent your service is or great your products are, you will lose customers. This doesn’t mean you can’t achieve and maintain a “good” churn rate – or, at least, one that’s acceptable. But what is a good churn rate, anyway? Well, that depends on your industry.

Some sectors have significantly higher rates of customer attrition than others. However, it’s difficult pinning down average customer churn rates by industry because, for some reason, most companies aren’t too keen to broadcast how many customers they lose on a regular basis. Weird.

Image © Bethesda Softworks

However, there is some data out there that can give you a better idea of what you can expect in certain sectors.

Customer Churn Rates by Industry

Here are the average customer churn rates in a few common industries:

- American credit card companies typically have customer churn rates of around 20%

- European cellular carriers experience churn rates of between 20-38%

- Certain American telcos, such as Verizon, have reported very low churn rates – like 0.84% in Q2 2012 (possibly due to service agreements)

- Software-as-a-Service (SaaS) companies usually report client churn rates of between 5-7%

- Many retail banks have churn rates of between 20-25%

- In 2003, the churn rate of daily newspaper subscriptions in the U.S. was 58%

Customer churn rates that could be considered fantastic for one business might be atrocious for another. Why? Because not all business models are the same, and even companies with similar business models might define churn differently.

Let’s say your business operates on a subscription model. How long are your subscription contracts? How much does the lifetime value of a typical customer change in relation to the length of their contract? How long does it take to recoup the initial costs of customer acquisition and for the account to become profitable? On average, how many new customers do you attract per month? These are all questions that will affect what client churn rate you should be aiming for.

6 Ways to Reduce Customer Churn

So, now that you’ve got a rough idea of a churn rate that’s acceptable for your business, how do you reduce client churn? By going the extra mile, right from the start.

Make a Great First Impression

Customers are less likely to look around for something better if you blow them away from the very first moment they encounter your business.

Josh Ledgard, co-founder of KickoffLabs, says that the first five minutes with a new customer are paramount. If someone sees immediate results when using a product or service for the first time, they’re significantly less likely to look for opportunities to churn because they believe that they could be even more successful as time goes on.

The better a customer’s first experience, the stronger their commitment and buy-in will be – and the chances of them churning further down the road will be lower.

Consistently Exceed Customers’ Expectations

Failing to deliver on a promise is one of the fastest ways to lose a customer, and many companies say that dissatisfaction and unmet expectations are among the top reasons for client churn. It’s not enough for you to just make a great first impression – you also have to consistently meet your customers’ expectations and exceed them whenever possible.

You could be forgiven for thinking that you start meeting and exceeding your customers’ expectations when they’re already a full-fledged user of your products or service, but the process begins much earlier than that – specifically, with your sales team during the very first call. Don’t let reps who are trying to meet their monthly quota oversell your business or make promises you can’t keep, or you’ll find it very difficult (or impossible) to meet your customers’ expectations, never mind exceed them.

Be honest about what your customers can expect, and consistently deliver what you promise.

Provide Awesome Customer Service

This one should go without saying, but if you’ve ever spent half an hour listening to hold muzak waiting for a disinterested, incompetent customer service rep to “assist you,” you’ll know that some companies simply don’t put enough effort into customer service.

Image © Scott Adams

A recent survey by Zendesk revealed precisely what drives people crazy about customer service. Some key takeaways:

- 42% of respondents said repeating their problem to multiple reps was the most frustrating aspect of dealing with customer service departments

- 35% of consumers stop doing business with a company altogether after a single negative customer service experience

- 16% of irate customers will vent their frustrations on social media sites following a negative interaction (a figure that seems very low to me) – but only 8% will do the same to praise good customer service

- 60% of consumers are strongly influenced by comments about companies on social media sites

Something else to consider is being proactive, rather than reactive, when it comes to customer service. Don’t wait for customers to come after you with burning torches and pitchforks; make sure you have an outreach initiative in place to check in with customers long before problems arise.

Remember – it’s much cheaper to retain an existing customer than it is to acquire a new one.

Listen Carefully to What Your Customers Tell You

Some business owners think that nobody knows their business better than they do, but they’re wrong – their customers do. Listening carefully to feedback from customers is one of the best ways to identify those who may be at risk of jumping ship.

For example, if a customer threatens to close their account because your service costs too much, they might actually mean that they haven’t had time to fully explore the product, resulting in a misconception about its true value. Then again, it could mean that you really are charging too much.

Whatever your customers tell you, try to really listen to what they’re saying. Think about how sales professionals overcome prospects’ objections – many people throw up “smokescreen” objections that may not necessarily be legitimate concerns, simply because they dislike being “sold to.” Be ready to help make your customers’ lives easier with real solutions based on what they’re actually saying, not what you think they’re saying.

Of course, in some cases, you’ll have little choice but to…

Let Some Customers Churn

This is another concept that some business owners find difficult to wrap their head around, but sometimes, you just have to let customers go.

This doesn’t mean you should ignore client churn rates, be content to provide poor service, or adopt a revolving-door policy when it comes to customer acquisition. It does mean, however, that you should know when to give up and let a customer walk. How do you know when it’s time to break up with a customer? By looking at the situation with profitability in mind.

Let’s say you identify a group of customers who are at risk of turning to a competitor. You immediately reach out to them and offer a generous incentive to stay, right? Wrong. First, you should figure out if the at-risk customers are even worth saving.

This concept is utterly alien to many businesses, because they mistakenly assume that all customers are equally valuable. Sure, this may be the case for some companies, but most businesses have a core group of customers who spend more, evangelize about their products on social media, and stay with the business longer. However, even the most loyal customer can still defect to another company if they feel their needs are not being met or that they’re being taken for granted. This is why these are the customers who are worth spending time and money to retain.

Sunil Gupta, a professor of business administration at Harvard Business School, says that in addition to determining customers’ churn probability, businesses should also calculate:

- How much they spend

- The likelihood that they will respond positively to a retention incentive offer

- How much this offer will cost the business in terms of overhead or lost revenue

According to Gupta, businesses should only reach out to at-risk customers once they have all this information. Don’t settle for merely reducing client churn rates – focus on reducing churn and maximizing profits. You can read more about how to do this in “Managing Churn to Maximize Profits,” a research paper that Gupta co-authored with Aurélie Lemmens of the Tilburg School of Economics and Management.

Identify Why Customers Cancel, Then Fix It

Remember all that math we did earlier to calculate churn rates? Well, although you need to know what your churn rate is, you also need to know why customers stop doing business with you.

A lot of businesses fail at this because it involves asking some uncomfortable questions and admitting that they’re not actually awesome at everything after all. However, identifying the most common causes of abandonment – and acting on them to improve things – can be a great way to reduce customer churn rates.

Make sure you give customers plenty of opportunities to tell you why they’re leaving. This could be a (brief) survey, a multiple-choice question, a comment field in a “We’ll miss you!” email – anything. Just make sure you can figure out why you’re losing customers, then take steps to tackle the most frequent reasons people are abandoning you.

Hopefully you can apply some of these client churn tips to your own business. Unless you have a churn rate of zero, of course, in which case more power to you (your pants appear to be on fire).